Get started

We Make Compliance Easy.

Are you taking off in Germany? One-stop-shopping with S+P Compliance Services.

We make compliance in Germany easy so you can focus on running your business.

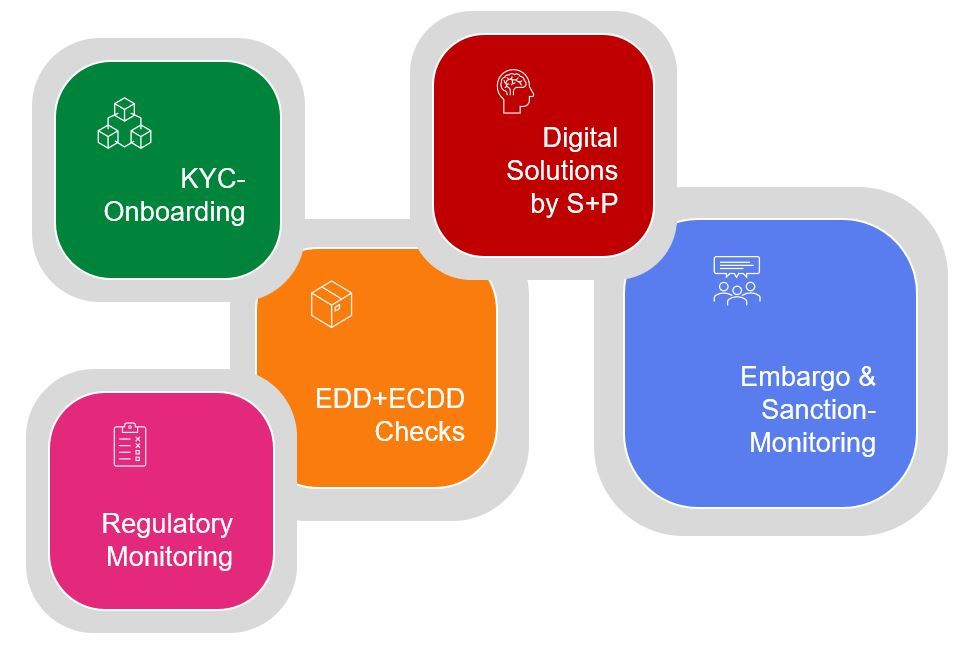

Innovative solutions to move your business forward

Just 3 Simple Steps

We look forward to working with you!

To make the perfect cooperation possible you only need to follow these three steps:

Send a message

Tell us which compliance functions you want to outsource.

Receive an offer

You will then receive a quote from us and we can discuss the details.

Sign the contract

Finally, you can sign the contract in which all the tasks and requirements are specified.

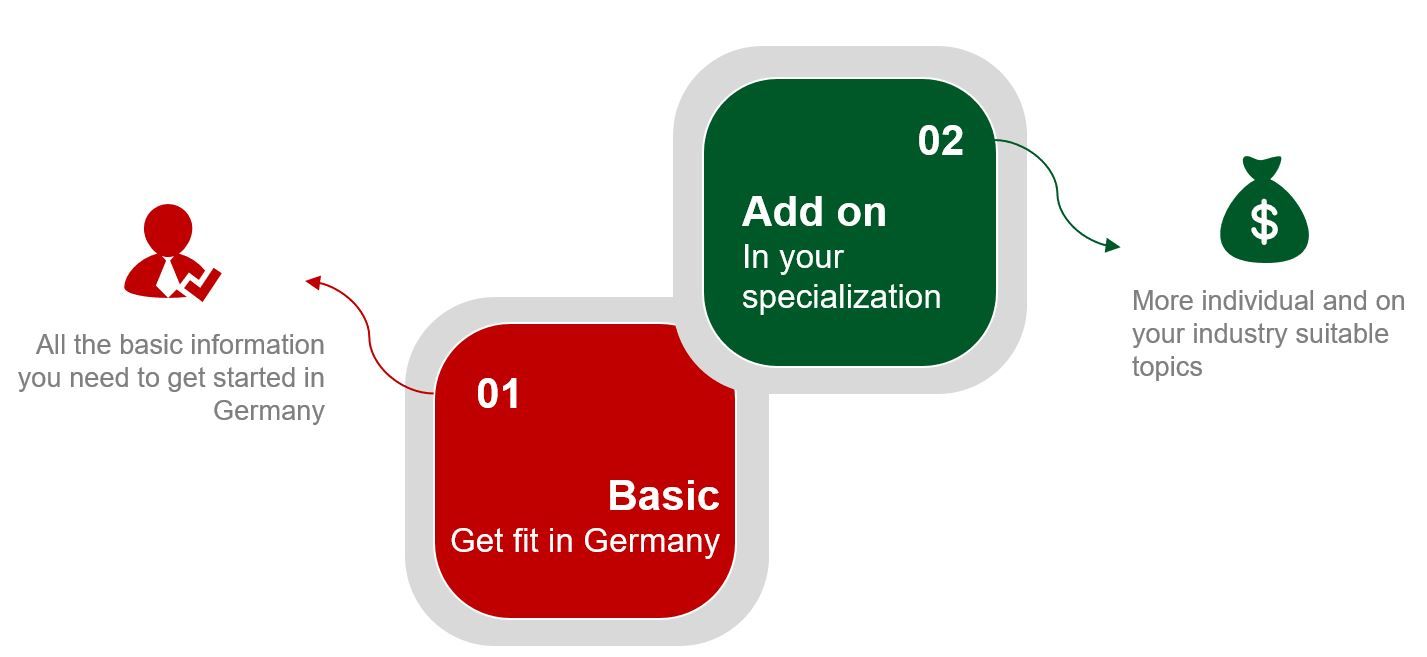

Get ready for Germany as a financial firm

You want to prepare and educate yourself for your success in Germany? With the courses of S+P you get all the information and tools you need for the start of your business in Germany.

Learn how to lead a financial firm in Germany

Day 1:

- Rights and duties of the management board in financial firms

- Audit-proofed organization of the management board

Day 2:

- Balance sheet knowledge for managing directors in financial firms

- Risk management in financial firms

Selected sectors – Clients

Crypto custody business

Multinational social trading, multi-asset brokerage and investment platform company focused on crypto

Investment Firms

S+P supports US and UK investment firms in their activities in Germany.

Payment service provider

Leading global provider of financial transfer services

Banks

Nationally and globally active banks with a focus on institutional investors, business and private customers

FinTech Banks

Europe’s leading FinTech bank with smartphone services

IT service provider

Germany’s leading IT service provider for financial companies

Discover what makes us special

S+P Compliance Services is a leading provider of compliance services. We offer our customers the opportunity to concentrate on their core business while we take care of all compliance-related tasks .

In addition, we support our customers in designing and implementing compliance measures. With our experience and know-how, you are fully covered.

We provide a one-stop solution for all your compliance needs.

S+P Compliance Services enables companies to outsource their compliance officer and thus save costs. We take full responsibility for your compliance activities and ensure that you remain in line with all legal requirements.

Let us take care of compliance for you with S+P Compliance Services.

One-stop-shop for all compliance matters in Germany.

If you’re looking for a leading provider of compliance services in Germany, look no further than S+P Compliance Services. We can help you with all aspects of compliance, from ensuring that your products and services meet all relevant regulations to providing training and support on compliance issues.

Getting started with us is easy. Simply get in touch with our team and let us know your compliance needs. We’ll then work with you to develop a tailored solution that meets your specific requirements. So don’t delay, contact S+P Compliance Services today and take the first step towards ensuring compliance in your business.

S+P Compliance Services – your partner in compliance for Germany.

Outsourcing the compliance function often involves a lot of effort. We will show you how to minimize the effort and still meet all requirements! With one stop shopping you can get everything from one source! We explain what it is and what advantages it has.

S+P Compliance Services is a one stop shop for outsourced compliance services. We offer a cost-effective, effective and tailor-made solution for your needs.

We specialize in providing financial and non-financial corporate services. With S+P Compliance Services you get access to the best compliance experts in the industry. We offer you the compliance functions required by law.

Auditing compliance with laws and regulations

We regularly review your business operations to ensure you comply with all legal requirements. If we find a problem, we’ll let you know immediately and help you fix the problem.

Advice on compliance issues

We advise you on all aspects of your compliance strategy. We help you to develop a compliance policy that is specially tailored to your company. We also support you in the implementation and monitoring of these guidelines.

Training and education of employees

A key aspect of our services is the training and education of your employees. We ensure that all employees are informed about the applicable laws and regulations and how to implement them in their daily work. We also offer regular training so that your employees are always up to date with the latest developments.

How S+P Compliance Services can help your business in Germany

1. What is compliance and why is it important?

Compliance refers to adhering to regulations or guidelines set forth by an authority. In the business world, this often takes the form of financial compliance, meaning following laws and best practices in order to avoid penalties or legal action.

Why is compliance important? Because it helps ensure that businesses are operating ethically and within the bounds of the law. This protects both the businesses and their customers, and helps create a level playing field. S+P Compliance Services is a leading provider of compliance services in Germany. We help businesses stay compliant with all relevant laws and regulations, so you can focus on running your operations smoothly and efficiently. Contact us today to learn more about our services.

2. What are the benefits of using S+P Compliance Services?

If you are looking for a compliance service provider in Germany, then S+P Compliance Services is the perfect choice for you. We are a leading provider of compliance services in the country and have a wealth of experience to offer our clients. Here are just some of the benefits of using S+P Compliance Services:

• Expertise – S+P Compliance Services has a team of highly experienced compliance experts who can provide you with the guidance and support you need to ensure that your business is compliant with all relevant regulations.

• Cost-effective – S+P Compliance Services offers competitive rates for their compliance services, so you can be sure that you are getting value for money.

• Flexible – S+P Compliance Services is flexible and can tailor their services to meet your specific needs. If you are looking for a reliable and experienced compliance service provider, then look no further than S+P Compliance Services. Contact us today to find out more about what they can do for you.

3. What are the risks of not complying with regulations?

If your company does business in Germany, it’s important to be aware of the compliance risks associated with not following regulations. By not complying with regulations, your company could face hefty fines, or even be banned from operating in the country.

If your company does business in Germany, it’s important to be aware of the country’s stringent compliance regulations. Failure to comply can result in costly penalties, and could even put your business at risk of being shut down. S+P Compliance Services is a leading provider of compliance services in Germany, and can help your company avoid these risks. We offer a comprehensive range of compliance services, from initial consultation to ongoing support. Contact us today to learn more about how we can help you stay compliant with German regulations.

Don’t take chances with your business in Germany – let S+P Compliance Services help you stay compliant and avoid the risks of non-compliance.

4. How can you get started with S+P Compliance Services?

If you’re looking for a leading provider of compliance services in Germany, look no further than S+P Compliance Services. We can help you with all aspects of compliance, from ensuring that your products and services meet all relevant regulations to providing training and support on compliance issues.

Getting started with us is easy. Simply get in touch with our team and let us know your compliance needs. We’ll then work with you to develop a tailored solution that meets your specific requirements. So don’t delay, contact S+P Compliance Services today and take the first step towards ensuring compliance in your business.

One-stop-shop for all compliance matters.

5. In a nutshell – S+P Compliance Services

S+P Compliance Services helps companies in Germany to comply with regulations and standards. We provide comprehensive services that cover all aspects of compliance, from risk assessment to implementation and monitoring. Our team of experts has a deep understanding of the compliance landscape in Germany, and we can help your company navigate it effectively.

We work with companies of all sizes to ensure that they are compliant with the latest regulations. We also provide training and support to help companies stay up-to-date with the latest compliance issues.

S+P Compliance Services – for a compliant future.