Get started

We Make Compliance Easy: Your Certified Partner for Germany Market Entry.

Are you taking off in Germany? One-stop-shopping with S+P Compliance Services.

We make compliance in Germany easy so you can focus on running your business.

Our services are certified to ISO DIN 9001, ISO 27001, IDW PS 951, and ISAE 3402 standards, ensuring the highest level of quality, information security, and audit reliability.

Why is Compliance Outsourcing Germany Essential for Market Entry?

Starting your business or expanding operations in Germany involves navigating a complex web of regulatory requirements.

Securing reliable Compliance Outsourcing Germany services is not just a strategic advantage—it is a mandatory step to mitigate liability risks and ensure a smooth market entry. The S+P Compliance Package offers a certified, one-stop solution designed to handle all your governance, risk, and compliance (GRC) needs, allowing you to focus on your core business growth.

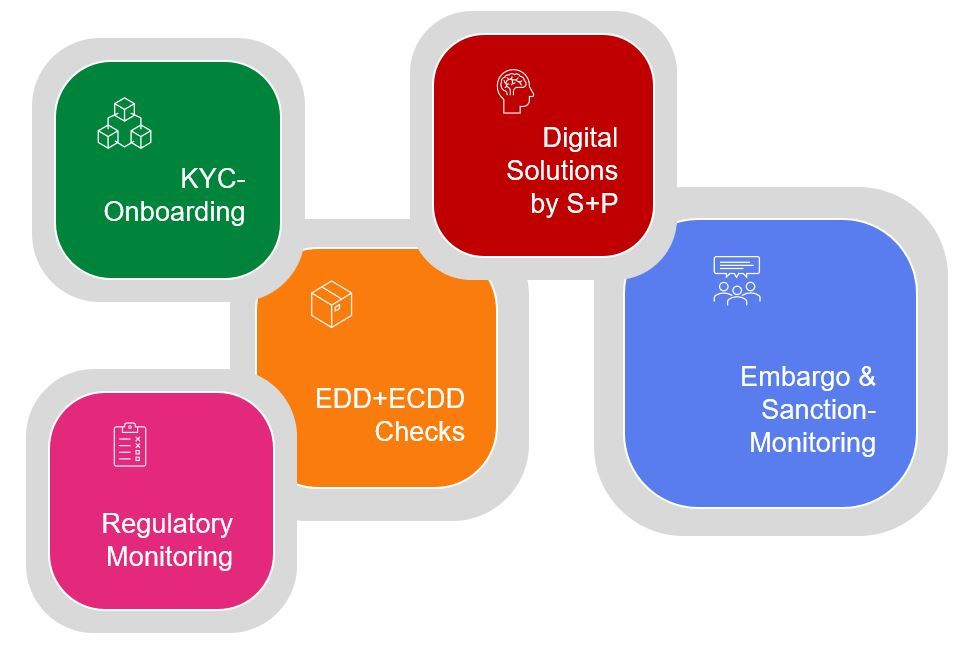

Our Core Compliance Outsourcing Solutions for Germany

Compliance All-in-One Package

Full Governance: Bundle all essential roles for complete liability relief.Outsourcing MLRO (GwG)

Certified Anti-Money Laundering Officer for audit-proof GwG compliance.Outsourcing WpHG Officer

MiFID II expertise: Specialized compliance for securities and investment firms.Outsourcing MaRisk Officer

Risk Management Governance compliant with BaFin MaRisk and IKT regulations.Internal Audit Outsourcing

Independent, certified Internal Revision to meet MaRisk requirements effectively.Outsourcing Compliance Officer

Your external expert for all general compliance and regulatory tasks in Germany.Outsourcing Management (MaRisk)

Control and governance of all delegated functions (Due Diligence & Monitoring).S+P Compliance Services – Your Benefits at a Glance

| Service Area | Description | Your Benefit |

|---|---|---|

| Outsourcing of Compliance Functions | S+P takes over roles such as Money Laundering Reporting Officer, Compliance Officer, ICT Function under DORA, and Internal Audit. | Save internal resources and gain access to expert knowledge on demand. |

| Compliance Management Systems (CMS) | Implementation of structured CMS to ensure effective governance and legal certainty. | More security, clear responsibilities, and reduced liability risks. |

| Regulatory Monitoring | Ongoing monitoring of legal changes and supervisory requirements. | Stay up to date and compliant – without internal research effort. |

| Focus on Financial Institutions | Serving banks, FinTechs, asset managers, financial and securities institutions in Germany, the UK, and the USA. | International expertise and sector specialization. |

| Specialized Services | KYC checks, integrity monitoring, transaction analysis, and whistleblowing systems. | Effective prevention and early detection of risks. |

| Regulatory Reporting & Risk Controlling | Support with regulatory reporting (e.g. EMIR, MiFIR, CRR) and establishing effective risk controlling functions. | Legally compliant reporting and early risk identification. |

| Experience & Expertise | Years of experience in the German compliance landscape – proven practical solutions. | Reliable advice at eye level and rapid implementation. |

| Comprehensive Compliance Partner | Modular services – tailored to your individual compliance needs. | Full flexibility and sustainable relief for your internal organization. |

Innovative solutions to move your business forward

Selected sectors – Clients

Crypto custody business

Multinational social trading, multi-asset brokerage and investment platform company focused on crypto

Investment Firms

S+P supports US and UK investment firms in their activities in Germany.

Payment service provider

Leading global provider of financial transfer services

Banks

Nationally and globally active banks with a focus on institutional investors, business and private customers

FinTech Banks

Europe’s leading FinTech bank with smartphone services

IT service provider

Germany’s leading IT service provider for financial companies

What`s new

Comprehensive Support Beyond Outsourcing

KYC as a Service

Innovative and Digital Solution for Onboarding Your Customers

We offer our S+P KYC Check for customers based in Europe and worldwide. KYC documents are stored in compliance with the EU GDPR.

Our services include:

- KYC Checks for natural and legal persons

- PEP Check and SIP Check

- Embargo and Sanctions Check

- CDD Check and EDD Check

Integrity Watch: Whistleblowing Systems

A whistleblowing system is set up as an online solution by the S+P Compliance Team in accordance with regulatory requirements:

- Use of the S+P Whistleblowing Portal (GDPR-compliant)

- Compliance with the Whistleblower Protection Act (HinSchG)

- Case management: Evaluation and initial assessment of whistleblowing reports

Integrity Compliance Monitoring

The S+P Compliance Monitoring is a full-service offering, including the following key features:

- PEP status verification of the customer

- Sanctions and embargo regulations screening

- Adverse media (SIP) monitoring

- Ongoing transaction monitoring

Information Register DORA & XBRL Support

Rely on us for reliable, compliant XBRL reporting.

- Automated XBRL reporting: Accurate and timely submission to the Deutsche Bundesbank.

- Risk management: Minimizing reporting errors and compliance risks.

- Long-term support: Training and ongoing support for sustainable compliance.

S+P XBRL Compliance Reporting

Trust us for accurate and compliant XBRL reporting.

- Automated XBRL reporting: Precise and timely submission to the Deutsche Bundesbank and BaFin.

- Risk management: Reducing reporting errors and compliance risks.

- Long-term support: Training and continuous assistance for sustainable compliance.

Just 3 Simple Steps

We look forward to working with you!

To make the perfect cooperation possible you only need to follow these three steps:

Send a message

Tell us which compliance functions you want to outsource.

Receive an offer

You will then receive a quote from us and we can discuss the details.

Sign the contract

Finally, you can sign the contract in which all the tasks and requirements are specified.

Frequently Asked Questions (FAQs) about Compliance Outsourcing

What liability risks are reduced by Compliance Outsourcing Germany?

Outsourcing roles like the MLRO or Compliance Officer significantly reduces personal liability for the management board. S+P ensures audit-proof processes and MaRisk/GwG compliance through certified expertise (ISO 27001), shifting operational risk to the specialized service provider. This secures the legal conformity required by the BaFin.

What specific roles are covered by the S+P One-Stop Compliance Package?

Our package covers all legally required GRC functions for financial institutions in Germany, including: Anti-Money Laundering Officer (GwG), WpHG Compliance Officer, MaRisk Compliance Officer, Internal Audit, and Outsourcing Management. This integrated approach ensures seamless governance and reporting.

Is Compliance Outsourcing the same as Regulatory Consulting?

No. Regulatory Consulting provides advice, strategy, and project support. Outsourcing, however, means S+P legally takes over the **full responsibility** for a specific mandatory function (e.g., MLRO) and its continuous operations. This provides management with ongoing, full compliance relief, not just temporary advice.