Acting Person – Implementation of §11 Paragraph 1 GwG

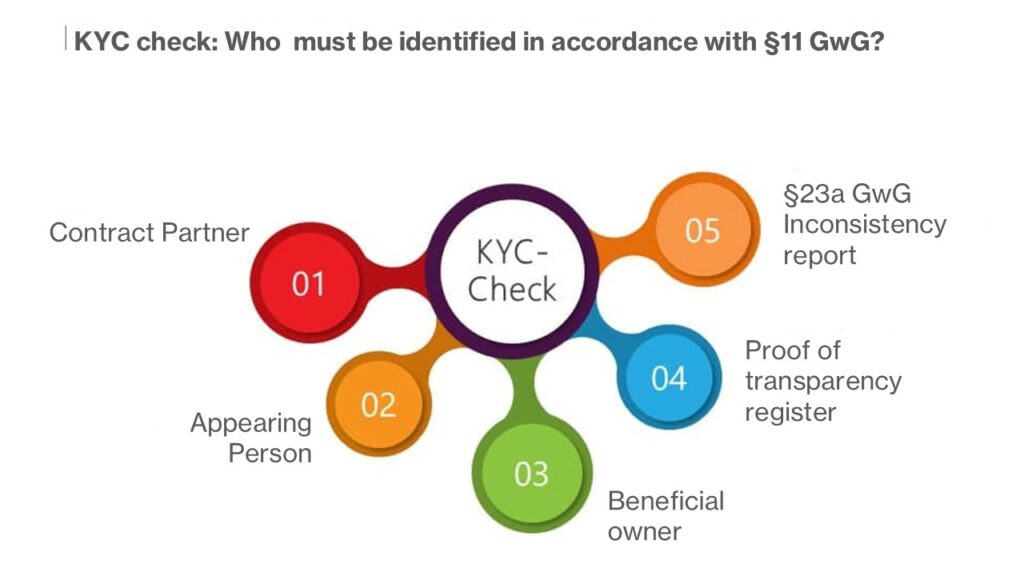

What obligations under the GwG must be observed for the acting person? When onboarding new customers, questions often arise under the Money Laundering Act (GwG), especially when it involves identifying individuals acting on behalf of contractual partners. The latest changes in the GwG lead to increased requirements for the identification process, particularly according to § 11 Paragraph 1 GwG, which concern the sales sector.

To comply with legal obligations, we explain the following points in this article:

- The correct procedure for identifying the acting person.

- The necessary documents and evidence required to verify representative powers.

- The current requirements of the Money Laundering Act that must be observed during the identification process.

🛡️ Implementation of § 11 Paragraph 1 GwG: Acting Person

| Step | Measure | Legal Basis |

|---|---|---|

| 1. Onboarding Check | Determination of whether the contract partner is a natural or legal person. Identity verification via ID or register extract. | § 11 Paragraph 4 GwG |

| 2. Acting Person | Identification of the acting person. Verification of representative authority through power of attorney and signature comparison. | § 11 Paragraph 1 GwG |

| 3. Beneficial Owner | Determination and verification of the beneficial owner, if necessary fictitious as management. | § 11 Paragraph 5, § 3 Paragraph 2 Sentence 5 GwG |

| 4. Transparency Register Reconciliation | Reconciliation with the transparency register. Obtaining proof or extract. Reporting discrepancies. | § 11 Paragraph 5, § 23a GwG |

| 5. Record Keeping Obligations | Collection and storage of all relevant data including copies of IDs (in compliance with data protection). | § 8 Paragraph 1 and 2 GwG |

Revised Identification Obligations under the Money Laundering Act (GwG)

With the innovations in the Money Laundering Act (GwG), especially in § 11 GwG, we face adjusted identification obligations that affect both natural and legal persons:

For initial contact with business partners:

- Natural Persons: According to § 11 Paragraph 4 GwG, the full name, place of birth, date of birth, nationality, and residential address must be recorded. Identity must be verified using a valid ID document, with a copy made as per § 8 Paragraph 2 GwG, but only specific, legally permitted data may be shown.

- Legal Persons and Partnerships: Here, according to § 11 Paragraph 4 GwG, the company name or designation, legal form, registration number, and the address of the headquarters or main establishment must be determined, as well as the names of members of the representative body or legal representatives.

Record Keeping Obligations for the Acting Person

According to § 8 Paragraph (1) GwG, the obligor must record the information collected and obtained about contractual partners in the course of fulfilling due diligence obligations. This also applies to the data on the persons acting for the contractual partner and beneficial owners.

When making copies of IDs, care must be taken under § 8 Paragraph 2 GwG to pay attention to data protection, and only the data necessary for identification may be copied.

Peculiarities in the use of a passport:

- If the address is missing in the passport, it must be requested separately according to § 11 Paragraph 4 GwG. Address verification is not always necessary, except in cases of reasonable doubt about the information.

For already identified customers:

- According to § 11 Paragraph 4 GwG, re-identification is not required as long as the business relationship continues. For occasional transactions, repeated identification is necessary

What Should Be Considered Regarding the Identification of the Beneficial Owner?

§11 Paragraph 5 GwG provides clear guidelines for determining identity. Contrary to §11 Paragraph 4 GwG, the obligor must at least ascertain the name and, if required from a risk perspective, collect additional identification characteristics to an appropriate extent.

Birth date, place of birth, and address of the beneficial owner can be collected regardless of the identified risk. The obligor must ensure through risk-appropriate measures that the information collected for identification is accurate; the obligor cannot solely rely on the information in the transparency register.

Record Keeping Obligations for the Acting Person

When making copies of IDs, care must be taken under § 8 Paragraph 2 GwG to pay attention to data protection, and only the data necessary for identification may be copied.

Onboarding New Customers: The Customer Journey

Identification under the Money Laundering Act involves two essential steps (§1 Paragraph 3 GwG): First, gathering relevant information to determine the identity of a person or company. This includes details such as name, date of birth, or company information.

The second step is verification of this information. The collected information is verified against official documents or register entries to confirm accuracy and authenticity.

1. Onboarding Check

When a customer registers for the first time, it must first be determined whether the contractual partner is a natural or a legal person:

- For natural persons, identity must be recorded and verified using a valid official ID.

- For legal persons, identity must be recorded and verified using an extract from the commercial or cooperative register or a comparable official register or directory, or using founding documents or equivalent probative documents.

2. Information on the Acting Person

If a third party acts for the contractual partner, this person must also be identified using a valid official ID and it must be checked whether the acting person is authorized to represent.

The verification of representative authority is carried out by means of a power of attorney and a signature comparison. For a signature comparison, the signature of the representative body is compared with, for example, a copy of the managing director’s ID or the company’s signature directory.

3. Checking the Information (§1 Paragraph 3 GwG)

In the next step, it must be clarified whether the contractual partner acts for a beneficial owner. If this is the case, the beneficial owner must also be identified.

For legal persons where no beneficial owner can be determined, the management must be recorded as the “fictitious” beneficial owner (cf. §3 Paragraph 2, Sentence 5 GwG).

4. Reconciliation of Information with the Transparency Register

- According to § 11 Paragraph 5 GwG, when establishing a new business relationship with an association under § 20 GwG or an arrangement under § 21 GwG, the obligor must obtain proof of registration according to § 20 Paragraph 1 GwG or § 21 GwG or an extract of the data accessible via the transparency register.

- According to § 23a GwG, discrepancies must be reported to the register authority. The obligor according to § 23 Paragraph 1 Sentence 1 Number 2 GwG must report discrepancies to the register authority immediately, which it finds between the information about the beneficial owners accessible in the transparency register and the information and findings available to them about the beneficial owners.

- The register authority must immediately review the discrepancy report according to Paragraph 1. For this purpose, it may require the submitter of the discrepancy report, the affected association according to § 20 GwG, or the arrangement according to § 21 GwG to provide the information and documents necessary for clarification.

- After the process of reviewing the discrepancy report is completed, the submitter of the discrepancy report must be informed immediately by the register authority about the result of the review. The process is considered completed when the register authority or the authority according to § 56 Paragraph 5 Sentence 2 GwG, based on the findings obtained from Paragraph 3 or based on a new notification from the association according to § 20 GwG or the arrangement according to § 21 GwG, which is the subject of the discrepancy report, has concluded that the discrepancy has been resolved.

Identification Obligation for Acting Persons – BaFin Interpretative Notes Chapter 5.1.2

| Case Constellation | Identification Obligation | Examples / Remarks |

|---|---|---|

| Legally Appointed Representative When Establishing a Business Relationship | ✅ Yes | Authorized third party opens account or depot for a customer |

| Legal Representative When Establishing a Business Relationship | ✅ Yes | Parents for minors, guardians, or members of the executive body of a legal person |

| Courier or Legally Appointed Representative for Individual Transactions (Outside of Existing Relationship) | ✅ Yes | Cash deposit or purchase of precious metals from €1,000 for a third party |

| Non-account bound payment ≥ €1,000 for a third party | ✅ Yes | Cash payment in the branch for a third party without account reference |

| Courier/Authorized within Existing Customer Relationship | ❌ No | Customer’s employee regularly deposits cash into the customer’s account |

| Deposit or Transfer to the Contract Partner’s Account by Authorized Persons | ❌ No | Power of attorney or simple authorization is sufficient; no identification required |

| Online Presence When Establishing a New Business Relationship | ✅ Yes | Digital power of attorney via online platform – the same examination standard as in physical presence |