What is a financial sanction?

What is a financial sanction? The Deutsche Bundesbank has published a leaflet on compliance with financial sanctions . Restrictions in the area of capital and payment transactions exist, inter alia, in connection with (financial) sanctions (including the sanctions regimes to prevent the financing of terrorism and proliferation).

What are your obligations as a money laundering officer when checking the sanctions list? With the S+P Tool Box you receive 13 checks to ensure your monitoring obligations to comply with financial sanctions and embargoes.

# What is a financial sanction?

The sanctions applicable in Germany are based on decisions

- the United Nations (UN) Security Council,

- the Council of the European Union (EU),

- by the domestic authorities (individual intervention by the Federal Ministry for Economic Affairs and Energy on the basis of Article 6 Paragraph 1 in conjunction with Article 4 Paragraphs 1 and 2 AWG).

While the resolutions of the UN Security Council require transposition into national or European law, EU Council regulations in the field of foreign trade law (partly enacted to implement UN Security Council resolutions) apply directly.

The scope of application of the EU sanctions ordinances and thus also the group of those obligated under these ordinances is regulated identically for all EU sanctions regimes in the respective ordinances.1 National prohibitions on disposal and provision according to Sections 4 and 6 AWG apply within the scope of the AWG.

Violations of financial sanctions can be prosecuted as administrative offenses and, in certain cases, criminal offenses in accordance with Sections 18 and 19 of the Foreign Trade and Payments Act (AWG) and Section 82 of the Foreign Trade and Payments Ordinance (AWV).

In terms of civil law, transactions that violate prohibitions under financial sanctions law can also be void under Section 134 of the German Civil Code.

Responsibility for financial sanctions

According to the Foreign Trade and Payments Act and the relevant regulations of the EU Council, the Deutsche Bundesbank is responsible for the implementation of EU sanctions in Germany, insofar as these relate to “funds” in the sense of sanctions law (“financial sanctions”).

The term “funds” is interpreted broadly in sanctions law and does not only refer to cash and book money, but generally includes “financial assets and benefits of all kinds” such as checks, money claims, bills of exchange, publicly and privately traded securities and debt instruments including stocks and shares, warrants, mortgage bonds, derivatives, interest income, dividends, etc.

The operational activities in connection with the implementation of sanctions are carried out by the Financial Sanctions Service Center of the Deutsche Bundesbank in Munich (SZ FiSankt). In addition, the Deutsche Bundesbank’s Service Centers for Foreign Trade Audits and Reporting Questions (SZ AW) monitor compliance with financial sanctions in the financial sector as part of on-site inspections. The legal basis for the tests is Section 23 (2) AWG. According to Section 23 (1) AWG, information and the submission of documents can also be requested for this purpose.

jurisdiction goods

The Federal Office of Economics and Export Control (BAFA) in Eschborn is responsible for sanctions in the areas of goods, economic resources, technical assistance, agency services, services and investments .

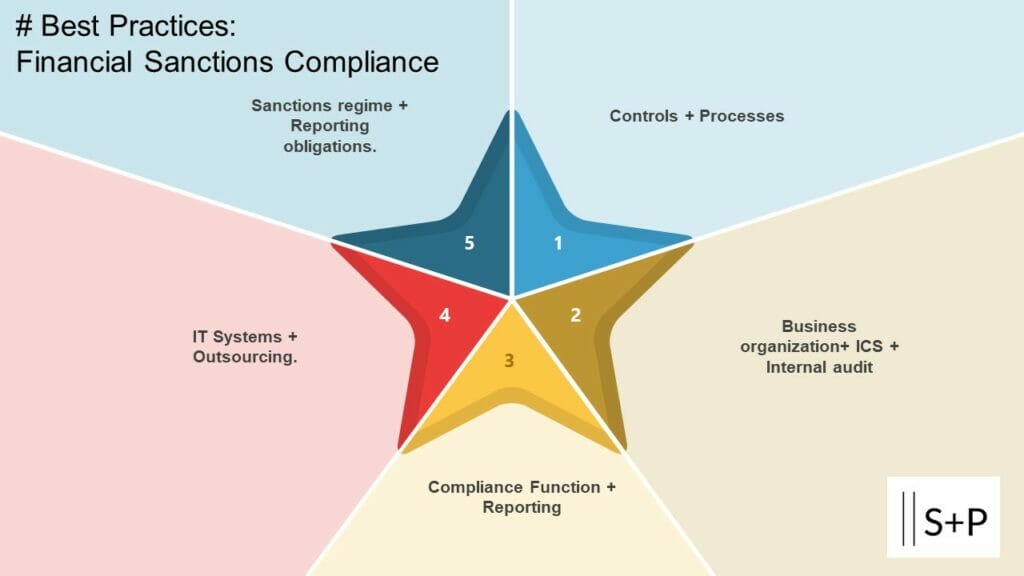

#1 Best Practices for Financial Sanctions Compliance

In order to comply with financial sanctions, institutions must implement appropriate controls and processes. “Best practices” for the financial sector to comply with financial sanctions have been published with the recommendations of RAG RELEX and the Financial Action Task Force (FATF).

Further regulations result from the German Banking Act, the minimum requirements for risk management (MaRisk) and the law on the supervision of insurance companies (Insurance Supervision Act – VAG).

The Best Practices are intended to provide institutes/companies with orientation when implementing

- controls and

- processes

to comply with the financial sanctions.

The controls and processes should be based on the risk content of the transactions and business relationships under sanctions law.

However, a fine or criminal relevance (§§ 18 f. AWG) could arise if a violation of a financial sanctions regime is determined, which can be causally attributed to insufficient controls or processes and the competent authorities or courts come to the conclusion that the the care required in traffic has not been observed.

This applies in particular if the Deutsche Bundesbank has already informed the institution concerned of the inadequate controls or processes that caused the violation (e.g. as part of a foreign trade audit).

Check with the S+P Tool Box: What is a financial sanction?

Are controls and processes for compliance with financial sanctions described?

#2 Section 18 AWG: Which criminal provisions apply to financial sanctions?

Section 18 Penal Provisions

(1) Anyone shall be punished with imprisonment from three months to five years

1.a

a) Export, import, transit, transfer, sale, purchase, delivery, provision, transfer, service or investment ban or

b) Ban on disposal of frozen funds and economic resources

violates a directly applicable legal act of the European Communities or the European Union published in the Official Journal of the European Communities or the European Union, which serves to implement an economic sanctions measure adopted by the Council of the European Union in the area of the common foreign and security policy, or

2. against an authorization requirement for

a) the export, import, transit, transfer, sale, acquisition, delivery, provision, transfer, service or investment or

b) the disposal of frozen funds or economic resources

of a directly applicable legal act of the European Communities or the European Union published in the Official Journal of the European Communities or the European Union, which serves to implement an economic sanctions measure decided by the Council of the European Union in the area of the common foreign and security policy.

(…)

https://www.gesetze-im-internet.de/awg_2013/__18.html

#3 Business organization, internal control system (ICS) and internal audit

Effectively complying with financial sanctions requires clear definition and alignment of

- processes and

- the associated tasks, competencies, controls, responsibilities, escalation levels in the processing of suspected cases as well

- communication channels

essential.

The management of the institute/company has to ensure that the business activities are carried out on the basis of organizational guidelines.

In order to comply with the financial sanctions, manuals, written work instructions or work process descriptions must be available for the compliance function and, if necessary, decentrally for individual areas such as payment transactions, customer acceptance, documentary business.

The appropriate level of detail in the organizational guidelines depends on the nature, scope, complexity and riskiness of the business activities.

The written work instructions must be made known to the employees concerned in a suitable manner. It must be ensured that the current version is available to employees. Employees must be trained regularly.

The manuals and work instructions must be promptly adapted to changes in activities and processes.

In every business area of an institute/company, it must be ensured that the requirements in the manuals and work instructions for compliance with the financial sanctions are met. Appropriate controls of the business processes must be set up for this purpose. This must be ensured organizationally.

Check with the S+P Tool Box: What is a financial sanction?

Are escalation levels and communication channels described?

Are there regular training measures for employees?

#4 What are the responsibilities of the compliance function and reporting in the event of financial sanctions?

The compliance function shall work towards the implementation of effective procedures for compliance with the financial sanctions and corresponding controls and monitor these controls.

The compliance function should support and advise the management, in particular with regard to the implementation of the basic legal regulations. Compliance officers should report regularly to senior management regarding compliance with financial sanctions.

Material information regarding financial sanctions must be forwarded to senior management immediately

Check with the S+P Tool Box: What is a financial sanction?

Is the compliance function involved in ongoing reporting?

#5 Internal Audit Reviews: What is a Financial Sanction?

The company’s activities and processes for compliance with financial sanctions, even if they are outsourced, must be reviewed at appropriate intervals, generally within three years.

If there are special risks, they must be checked annually. In the case of activities and processes that are not significant from a risk perspective, the three-year cycle can be deviated from.

The risk classification of the activities and processes must be checked regularly and documented accordingly.

Check with the S+P Tool Box: What is a financial sanction?

What examination cycle has been set?

#6 Documentation of financial sanctions controls and processes

All controls and processes related to financial sanctions must be documented. The prepared control and monitoring documents, including those on the processing of suspicious cases (and the decision criteria used here) are to be drafted systematically, in a way that is comprehensible for knowledgeable third parties, and to be stored in accordance with the relevant statutory regulations (e.g. Section 147 of the Fiscal Code, Section 257 of the Commercial Code).

It is to be ensured that the records are kept up-to-date and complete.

Check with the S+P Tool Box: What is a financial sanction?

Are the control actions documented?

Is there an audit trail?

#7 IT systems and outsourcing

IT systems

It is expected that the institutes/companies will use IT-supported screening systems or other procedures based on operational requirements, business activities and the risk situation in order to be able to block or freeze accounts, custody accounts and assets immediately in the event of new listings and existing ones Being able to comply with bans on disposal and provision in payment transactions as well.

The IT systems are to be tested before they are used for the first time and after significant changes, and are to be accepted by the professionally and technically responsible employees. In addition, the IT systems and the methodology must be validated regularly in order to check their suitability and functionality.

Check with the S+P Tool Box: What is a financial sanction?

Are the IT systems validated at least once a year?

outsourcing

Responsibility for outsourced activities and processes that serve to comply with financial sanctions remains with the outsourcing institution/company. It must properly monitor and document the outsourced activities and processes.

This also includes regularly assessing the performance of the outsourcing company based on criteria to be maintained.

In the case of significant outsourcing, the institute/company must take precautions in the event of the intended or expected termination of the outsourcing agreement in order to ensure the continuity and quality of the outsourced activities and processes even after their termination.

Check with the S+P Tool Box: What is a financial sanction?

Are the outsourced activities in the area of monitoring financial sanctions part of outsourcing controlling?

#8 Provision, disposal and financing prohibitions as well as approval requirements

The institution/company must implement suitable techniques, procedures and methods in all business areas and processes affected by financial sanctions in order to:

- deployment and

- prohibitions on disposal

to be able to effectively implement with regard to sanctioned natural or legal persons as well as not personal, but goods or business-related financing bans and restrictions8.

Furthermore, appropriate processes must be set up in order to be able to observe reporting obligations to the SZ FiSankt and to obtain the necessary approvals from the SZ FiSankt.

Check with the S+P Tool Box: What is a financial sanction?

Is it ensured that the sanctions lists and data sources used are up-to-date?

In detail:

New customer relationships (new customer creation)

When creating new customers/business partners, apart from legally standardized exceptions, identification must be carried out using official identification documents and then (at the latest before access rights are granted or other possibilities to dispose of funds are granted) a check for possible sanctions must be carried out.

The names and data of the customers/business partners must be recorded correctly and the checks must be documented in a suitable manner. If, during the initiation of the contract or later, one or more other persons appear for the contractual partner as authorized persons or authorized persons who could have access to funds that are managed within the framework of the customer relationship, these persons must also be identified in a corresponding manner and checked in terms of sanctions .

The same applies to the beneficial owners determined by the institute/company.

customer base

After a legal act has come into force that contains new sanctions against certain natural or legal persons and groups, the customer base must be checked for matches in order to be able to block accounts/deposits/assets of sanctioned natural persons, legal persons or groups immediately.

The prerequisite for this is a review of the entire customer base and the persons and organizations who are authorized and authorized to dispose of the business relationships using current data sources. If the Deutsche Bundesbank has distributed a circular on the new legal act and combined this with a request for information, the result of the examination must be communicated to the Deutsche Bundesbank.

payment transactions

In cross-border payment transactions, at least the following fields must be compared with the current sanctions lists:

- payee (beneficiary),

- payment service provider of the recipient,

- payer (client),

- Payment service provider of the payer (client) and

- Purpose (e.g. using a keyword search).

This does not apply if a comparison already takes place as part of the ongoing check of the customer base.

In non-cash payments within Germany, until further notice, the institution of the ordering party and any intermediary institutions can refrain from checking whether the payee is affected by restrictions under foreign trade law.

The general obligations to prevent money laundering and terrorist financing (e.g. Section 25 h Para. 2 KWG) remain unaffected.

In addition, in the case of payment slip transactions, the identity of the customer must be checked and the customer, the recipient and the recipient institution must be subjected to a sanctions check.

Trade and Project Finance

Trade finance refers to the credit and guarantee business as well as payment instruments and financial services that serve to finance or secure trade in goods or services.

Project financing is a special form of financing for definable and usually large-volume investment projects (“projects”). Examples can be infrastructure financing.

In the area of trade and project financing, all parties involved in the respective transaction (in addition to the contracting parties, this may also include other persons/organizations/infrastructures such as freight forwarders, ships, manufacturers, banks involved, investors, etc.) must be compared with current sanctions lists , unless the affected natural or legal persons are already stored in the customer master data and are therefore the subject of the event-related or regular review of the customer base. In this way it can be ensured that the processing of the financing does not negligently violate existing prohibitions on disposal or provision.

In addition to bans on disposal and provision that are linked to the identity of the parties involved, some EU financial sanctions regulations also contain bans and/or reservations regarding the provision of funds or financial assistance that are linked to the goods or services to be financed or the type of project.

Appropriate procedures and processes must therefore be defined for transactions where such sanction risks are identifiable in order to ensure that relevant financing bans or approval requirements are complied with. This applies in particular to commercial transactions with a recognizable connection to sanctioned countries and areas or to dual-use or armaments.

When assessing whether a commercial transaction to be financed could be affected by sanctions, documents from the customs authorities or the Federal Office of Economics and Export Control (BAFA) can be used, insofar as they are available.

If there is a transaction that is subject to sanctions, you can (unless the transaction is unconditionally prohibited) apply for approval to provide funds or financial assistance from the Deutsche Bundesbank’s financial sanctions service center.

securities business

In the case of securities transactions, it must be ensured that existing prohibitions on providing and disposing of securities and any specific restrictions are observed. This means, for example, that securities and bonds from sanctioned companies may not be purchased if the purchase price paid for the security (indirectly) benefits the issuer.

Custody accounts of sanctioned customers/business partners are to be blocked (frozen) so that disposals of the securities held in the custody account are reliably prevented.

In the case of incoming payments from securities (repayment on maturity, interest, dividends, etc.), special provisions usually apply that allow the corresponding funds to be credited to the frozen account of the respective customer/business partner.

Check with the S+P Tool Box: What is a financial sanction?

Is there an audit trail for ongoing monitoring and control actions?

#9 Information on the sanctions regimes

Further information on the individual sanction regimes and the EU regulations as well as on (temporary) individual interventions by the Federal Ministry for Economic Affairs and Energy can be found on the Deutsche Bundesbank’s website at

https://www.bundesbank.de/de/service/finanzsanktionen

available.

The service center for financial sanctions of the Deutsche Bundesbank is on the telephone number

+49 89 2889 3800 (hotline).

In the EU, UN sanctions are implemented by EU regulations that apply directly in every member state. In addition, as part of the common foreign and security policy, the EU enacts its own sanctions based on Articles 28 and 29 of the Treaty on European Union and implements these through EU regulations based on Article 215 of the Treaty on the Functioning of the European Union around.

Consolidated versions of the EU financial sanctions regulations are made available – as (unofficial) work aids – via the internet portal

provided by the Publications Office of the EU.

These consolidated versions are also regularly available on the EU Sanctions Map overview portal, which provides a quick and comprehensive overview of the sanctions measures in force in relation to a specific country or specific groupings:

There you will also find information on the people, organizations and institutions that are listed under a specific sanctions regime. A consolidated list of persons, organizations and institutions for whom there is a comprehensive ban on disposal and provision due to an EU measure can also be found at

https://eeas.europa.eu/topics/common-foreign-security-policy-cfsp/8442/consolidated-list-of-sanctions_en

be retrieved.

You can also check whether individuals are subject to EU sanctions on the website of the Federal and State Justice Portal:

financial sanctions list, which is based on the consolidated EU sanctions list.

In exceptional cases, in particular for the timely implementation of UN sanctions, national disposal and provision bans in the form of individual interventions can also be issued in Germany on the basis of Sections 4 and 6 of the AWG. These are published in the official part of the Federal Gazette under

https://www.bundesanzeiger.de

released.

The Council Working Party of the External Relations Counselors Group (RAG RELEX) ‘EU Best Practices on the Effective Implementation of Restrictive Measures’ can be found at

https://www.consilium.europa.eu/de/policies/

and are also available in the “Sanctions Map” for the individual sanctions regimes under “Guidelines”.

Note on RAG RELEX:

Group of External Relations Officers (RELEX)

The RELEX group deals with legal, financial and institutional issues of the Common Foreign and Security Policy (CFSP).

Their priorities include

- sanctions

- EU crisis management operations

- Special Representative of the EU

- Financing of external action

- non-proliferation of weapons of mass destruction

- other cross-cutting issues

In 2004 a new “Sanctions” composition was established within the group. Its main task is to exchange best practices and to revise and implement the common guidelines to ensure the effective and consistent implementation of the EU sanctions regime.

#10 Reporting Requirements

Effective use of financial sanctions by the European Union and efficient implementation of the measures by the responsible authorities can only be guaranteed if sufficient information is available about the effects and results of the measures decided.

For this reason, extensive cooperation and information obligations are laid down in the financial sanctions ordinances. They oblige all persons and organizations subject to Union law to immediately transmit information that facilitates the application of the financial sanctions regulations, such as information about frozen accounts and amounts, to the competent authorities of the Member States (in Germany the Deutsche Bundesbank) and with these authorities cooperate in verifying the information.

The following SZ FiSankt e-mail address can be used for reports of this type:

sz.finanzsanktionen@bundesbank.de

The SZ FiSankt actively requests information about frozen accounts and amounts in Germany by sending e-mail circulars to all credit institutions based in Germany when financial sanctions are imposed on new addressees or when names (including aliases) or other identification features of persons who have already been sanctioned , organizations or institutions are changed.

The credit institutions are asked to report any frozen funds held by them to the SZ FiSankt within one week. Credit institutions that do not have frozen funds are asked to file a nil report.

The institutes based in Germany are expected to answer the queries of the SZ FiSankt promptly (a time window of one week is usually provided for this) and correctly.

In order to protect confidentiality, the respective sanctions regulations stipulate that the information collected in this way may only be used for the purpose of the effective application of the relevant financial sanctions measures.

The existence and reliable functioning of corresponding processes at the institutions can also be the subject of on-site inspections by the SZ AW on the basis of Section 23 (2) AWG.

Check with the S+P Tool Box: What is a financial sanction?

Are there written regulations on the reporting requirements?

#11 Prohibitions on disposal and provision

One of the most important and most serious measures in the area of financial sanctions is the imposition of bans on the disposal and provision of certain (natural and legal) persons, organizations and institutions listed in the annexes of the various EU sanctions regulations.

The “freeze of funds” (the usual term for the imposition of a comprehensive restraint on disposal) is defined in the financial sanctions regulations as the:

“Prevention of any form of movement, transfer, alteration, use of, access to, or use of funds which will alter the volume, amount, location, ownership, possession, character or destination of funds or other changes are brought about that enable the funds to be used, including asset management.”

Institutions whose customers and/or business partners include sanctioned persons or companies must therefore ensure that any funds from these customers/business partners are not disposed of (or not without official approval).

Important:

Financial sanction restraints apply not only to funds owned by a specific person, organization or facility, but also to those under their control.

Prohibitions on the provision of funds under financial sanctions law are intended to prevent the direct or indirect benefit of sanctioned persons, organizations or institutions.

While prohibitions on disposal can primarily be applied to intended disposal of funds from sanctioned customers/business partners,

bans on provision must be observed in general (ie fundamentally for all types of transactions as well as in payment transactions).

In order to be able to comply with applicable financial sanctions prohibitions on disposal and provision, it is important for companies in the financial sector to

- Obtain information about existing financial sanctions and

- to take precautions in the event that these measures become relevant to one’s own business.

Further assistance for the assessment of the questions of when funds are controlled by a sanctioned person, when an indirect provision of funds can be assumed and on other questions in connection with the implementation of prohibitions on disposal and provision can be found in the “Best Practices” of the Council Working Group of the External Relations Officers Group (RAG RELEX).

Check with the S+P Tool Box: What is a financial sanction?

Are there regulations for compliance with prohibitions on disposal and provision?

#12 Payment Restrictions

In some cases, not only bans on disposal and provision are imposed in relation to certain persons, organizations or institutions, but also general restrictions (bans and/or reservations about approval and, if necessary, reporting regulations) are imposed on payment transactions with certain countries.

It is necessary for payment service providers to track down corresponding payments in the mass of transactions to be processed and to ensure that processing only takes place if the necessary procedural steps are observed.

Currently, general restrictions on payment transactions are only provided for in the EU’s financial sanctions regime against North Korea.

High Risk Jurisdictions

Irrespective of this, there are specific restrictions in relation to so-called “High-Risk Jurisdictions subject to a Call for Action” of the Financial Action Task Force (FATF). High-risk jurisdictions have significant deficits in combating money laundering, terrorist financing and proliferation financing; Iran and North Korea are currently designated as high-risk jurisdictions.

In view of the current call by the FATF to issue effective countermeasures in the sense of recommendations against Iran and North Korea, general decrees by BaFin imposed a reporting obligation for business relationships and transactions related to Iran or North Korea.

Check with the S+P Tool Box: What is a financial sanction?

Are there written regulations for observing restrictions in payment transactions?

#13 Prohibitions and reservations of approval

Certain financial sanctions regimes contain restrictions (prohibitions or approval requirements) on the granting of financial assistance and funds (loans, guarantees, letters of credit, sureties, etc.) in connection with the trade in certain goods or services.

Since these restrictions are often not linked to the place of business of the contracting parties in a specific country, but to the intended place of use of a good or the place of provision of the service, appropriate measures can also take effect if none of the contracting parties is based in a sanctioned country Has.

People and companies that provide trade financing must be informed about the background to the financing transactions they have concluded in order to be able to recognize and observe relevant prohibitions or reservations about approval.

All existing sources of knowledge can be used here. However, EU financial sanctions do not justify a general obligation to investigate.

Check with the S+P Tool Box: What is a financial sanction?

Are there written regulations regarding the observance of prohibitions and reservations of approval?

You might be interested in this seminar on sanctions list checks and monitoring of financial sanctions.

Have you already prepared the implementation of the 6th EU Money Laundering Directive? With the Money Laundering and Fraud Advanced Seminar, participants learn current trends in money laundering and fraud structures in practice. The most important seminar topics are:

- Our practical seminar gives you a comprehensive overview of the current legal changes.

- Know your customer : Stricter requirements for money laundering prevention

- Money Laundering Act Update : What is changing?

- Sanction list check and monitoring of financial sanctions

Book the Money Laundering and Fraud advanced seminar online; conveniently and easily with the seminar form online and the product no. L04.

Target group for the Money Laundering and Fraud seminar

- Directors and executives at financial and non-financial companies

- Money laundering officers from financial and non-financial companies

Your benefit:

- Know your customer : Stricter requirements for money laundering prevention

- Money Laundering Act Update: What is changing?

Your lead:

Every participant receives the S+P Tool Box with the Money Laundering and Fraud Advanced Seminar:

- Organization Manual: Anti-Money Laundering and Fraud Systems

- Practical guidelines and checklists for examining complex money laundering structures

- Implementation Roadmap on Money Laundering

Your program:

Know your customer in demanding customer relationships

- Reliable identification of contractual partner and person appearing

- Evaluation of the source of funds – 3 test levels in practice

- Wealth Inflow: Source of Income

- Wealth Status: Source of Wealth

- Wealth Transfer: Source of Funds

- Techniques for researching the beneficial owner :

- Doubts about identity information

- Suspects: Suspicion of smurfing and structuring

- EDD examination techniques on Section 15 GwG

- Transactions outside and within the business relationship

- Sanction list check and monitoring of financial sanctions

Money Laundering Act Update: What is changing?

- Monitoring and screening system:

- Ex-post and in real time: selection and filtering of suspicious transactions

- Real estate transaction : share deals and nested company structures

- New due diligence requirements for financial companies:

- Investment business: KVG, brokers and banks

- syndicated loan business

- correspondent banking relationships

- Trade finance and transaction monitoring

- Monitoring of crypto transactions and use of virtual currencies